Latest Prices

CoinDesk 20 Index: 2,981.79 +0.61%

Powered By

The cryptocurrency market is showing signs of increased activity as prices fluctuate across various assets.

Bitcoin (BTC): $93,634.61 +2.04%

Ether (ETH): $3,090.71 -1.65%

S&P 500: 5,916.98 +0.40%

Gold: $2,628.53 -0.15%

Nikkei 225: 38,352.34 -0.16%

Top Stories

Bitcoin (BTC) Eyes Record Highs Once Again

Bitcoin is trading just below the new record high of $94,000 set on Tuesday and is leading the broader market with a 2% climb over the past 24 hours.

Large-Cap Altcoins Fall

Meanwhile, the broad-market CoinDesk 20 Index was little changed, while large-cap altcoins ether (ETH) and solana (SOL) fell.

Options Trading Activity on BlackRock’s Spot Bitcoin ETF

Options on BlackRock’s spot bitcoin ETF (IBIT) saw staggering first-day trading activity yesterday, pushing the BTC price higher. Analysts noted that most of the activity focused on calls, representing a bullish view, with some traders betting on a doubling of IBIT’s share price.

"It’s pretty interesting to see ‘professionals’ degen into $100 strikes (this effectively means a doubling of BTC prices given IBIT trades near $50)," crypto quant researcher Samneet Chepal noted.

Options on other BTC ETFs will follow in the coming days, fueling more activity.

Altcoin Trading Volumes Surpass Bitcoin’s

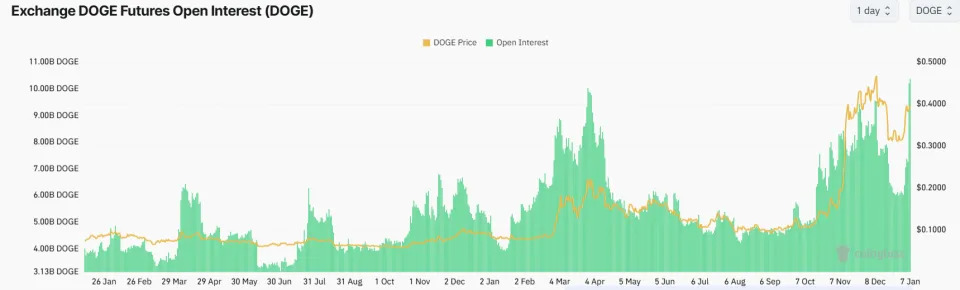

It’s not only bitcoin where the crypto action is concentrated. Trading volumes for popular altcoins dogecoin (DOGE) and XRP (XRP) surpassed BTC’s on South Korean crypto exchanges Upbit and Bithumb.

MicroStrategy Breaks into Top 100 U.S. Publicly Traded Companies

MicroStrategy (MSTR) broke into the top 100 U.S. publicly traded companies by market capitalization as its share price closed Tuesday’s session at a record $430, far above its dotcom bubble highs.

The firm owns the largest corporate bitcoin treasury in the world and its shares have rallied 528% this year, outperforming bitcoin and chipmaker giant Nvidia (NVDA).

CoinDesk analyst James Van Straten noted that the developments keep coming for the firm. On Monday, it announced a $1.75 billion 5-year convertible senior note issuance at a 0% coupon.

"We are waiting on further developments if this convertible note has been oversubscribed, which would increase its issuance by $250 million, for a total of $2 billion," Van Straten said.

Robinhood Poised to Benefit from Crypto Deregulation

Robinhood (HOOD) is poised to benefit the most from crypto deregulation in the U.S. under President-elect Donald Trump, broker Bernstein said in a report.

The trading app can drive higher revenues by listing new tokens and introducing new crypto product lines to target the wider opportunity, the report said. Robinhood’s acquisition of EU-based exchange Bitstamp and its European platform should "further boost value-added crypto services," the authors wrote.

Bernstein raised the price target for Robinhood shares to $51 from $30, which would translate to a 45% appreciation from Tuesday’s closing price.

Chart of the Day: U.S. 10-Year Yield

This might be the most important chart in financial markets. The yield on the U.S. 10-year note, the so-called risk-free rate, is at a make-or-break level.

It could break out above the downtrend line or turn lower, forming a head-and-shoulder top. The latter will likely bode well for risk assets, unless accompanied by a black swan.

Source: TradingView – Omkar Godbole

Trending Posts

Coinbase Delists Wrapped Bitcoin (wBTC), Citing ‘Listing Concerns’

Coinbase has delisted wrapped bitcoin (wBTC) citing listing concerns. The decision is likely to impact the price of wBTC, which has been trading at a premium to bitcoin.

Crypto Exchange Archax to Offer Tokenized Money Market Funds from State Street, Fidelity International and LGIM

Crypto exchange Archax will offer tokenized money market funds from leading asset managers State Street, Fidelity International, and LGIM. The move is aimed at increasing adoption of tokenized assets in the financial markets.

Meta’s Mark Zuckerberg Could Teach DAOs, Like Compound, a Governance Lesson

Meta’s Mark Zuckerberg has been vocal about his support for decentralized autonomous organizations (DAOs). However, some critics argue that DAOs like Compound could benefit from governance lessons from established companies.