Apple Reports Strong Earnings for Q1 2017

Apple Inc. has released its financial results for the first quarter of 2017, showcasing significant growth across various segments. The company reported $52.9 billion in revenue and an EPS (Earnings Per Share) of $2.10, slightly beating the consensus estimates of $2.02. This performance highlights Apple’s ability to maintain profitability despite a challenging market environment.

Growth in Services Segment

A key driver of Apple’s success this quarter was its services division, which reported $7.04 billion in revenue. This represents an 18% year-over-year (YOY) growth rate, matching the percentage achieved in the previous quarter. While the services segment has been a consistent contributor to Apple’s revenue for several quarters now, it is particularly noteworthy due to the significant increase in hardware sales during the holiday season.

Holiday Sales Impact

In this quarter, revenue from services was $7.04 billion, which is notably higher than last year’s figure of $6.85 billion. A substantial portion of this growth can be attributed to the increased sales volume during the holiday period, when consumers tend to purchase more expensive technology products like iPhones.

Comparison with Hardware Sales

Interestingly, while services revenue has remained stable or slightly increased compared to previous quarters, hardware sales have shown a sharp decline. For example, iPhone sales saw a 39% year-over-year decrease, and revenue from Apple Pay was down by 2%. Despite these challenges, the services segment continues to be a critical growth driver for Apple.

Investors Focusing on Services Growth

The services division has garnered significant attention from investors due to its potential for sustained growth. Last quarter, services accounted for 13.3% of total revenue, up from 11.8% in the previous year. This growth is attributed to Apple’s ability to monetize the hardware products it already owns, such as the App Store, iTunes Store, Apple Music subscriptions, Apple Pay, iCloud storage costs, and AppleCare.

Sustainability of Growth

Apple has positioned its services business as a long-term growth engine. By offering recurring revenue streams like Apple Music, iCloud Storage, and Apple Pay, the company aims to generate consistent income from existing customers without relying solely on new hardware sales. This strategy is particularly appealing to investors, who have shown increased interest in Apple’s services division.

Key Services Offering

The services portfolio includes a wide range of offerings:

- App Store: A platform for iOS apps and games, generating significant revenue through transaction fees.

- iTunes Store: A successor to the App Store, offering a similar range of digital products.

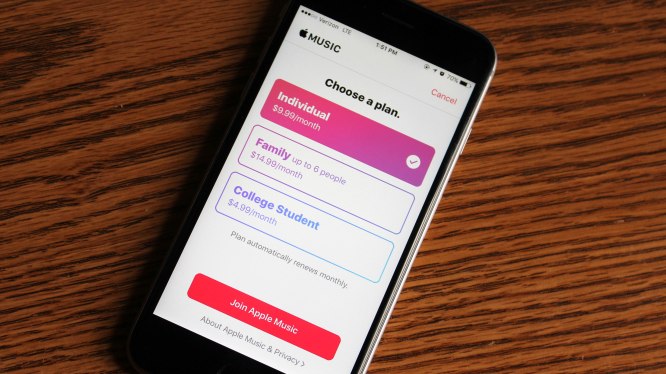

- Apple Music: A subscription-based service providing music streaming.

- Apple Pay: A contactless payment system integrated into iOS devices.

- iCloud Storage: A cloud storage service for syncing photos and files across Apple devices.

- Apple Care: An extended warranty program for Apple products.

Impact on Apple’s Strategy

The success of the services segment has influenced Apple’s overall business strategy. By investing in areas that generate recurring revenue, the company can reduce its reliance on hardware sales, which are subject to seasonal fluctuations and market trends. This diversification of revenue streams is a key factor contributing to Apple’s financial stability.

Investor Sentiment

Apple’s ability to maintain steady growth in its services segment has sent ripples through the technology sector. Investors have increasingly looked to Apple for a stable platform that generates consistent returns, even in challenging markets. The company’s focus on services has allowed it to capitalize on the increasing demand for digital content and mobile payment solutions.

Challenges Ahead

While the services division is performing well, there are challenges ahead. The ongoing competition from other tech companies, such as Google and Samsung, poses a threat to Apple’s dominance in the smartphone market. Additionally, changes in consumer behavior, particularly the rise of cryptocurrencies like Bitcoin, may impact the company’s revenue streams.

Conclusion

Apple’s Q1 2017 earnings demonstrate the effectiveness of its services division in driving growth despite challenges in hardware sales. The company’s ability to leverage existing products for recurring revenue is a key factor contributing to its financial success. As investors continue to focus on long-term growth potential, Apple remains a standout performer in the technology industry.