The article provides a comprehensive overview of various aspects influenced by the COVID-19 pandemic, blending detailed analyses with broader industry insights. Here’s a structured summary:

-

** Gary Tan and Initialized Capital**: The article highlights the involvement of venture capitalist Gary Tan in navigating challenges amid the pandemic, though specific investment details are not elaborated upon.

-

Fentanyl in Exports: An outlier section discussing Fentanyl placement amidst supply chain contexts may be misplaced but could hint at broader supply chain issues during the pandemic.

-

AI-Driven Trading Platforms (Flox and Ro): These companies leverage machine learning to predict market trends, demonstrating technology’s role in volatile sectors like trading, while acknowledging limitations despite human intuition.

-

China Auto Parts and China Steel Import: Both companies adapt by using Mexico-based shipping to bypass tariffs and establish US branches, illustrating strategies to circumvent trade barriers during the pandemic.

-

VentureBeat on Remote Work: Discusses reshaping of workspaces post-pandemic, affecting tech sectors adapting business models for remote environments.

-

ESG Impact Investment: Focuses on environmental, social, and governance factors influencing investor decisions, reflecting potential shifts in portfolio strategies as COVID-19 recovery impacts sustainability narratives.

-

FHFV Fund Strategy: Combines venture capital with financial instruments to offer flexible liquidity, providing a unique investment strategy that balances risk and return.

-

China’s Market Attractiveness: Notes recovery sectors attracting investments post-pandemic, influencing where capital allocates as companies adapt to economic changes.

-

Frost & Sullivan’s Role: Assists businesses in sustainability and digital transformation, aligning with global trends towards environmental responsibility and technological adoption for growth.

-

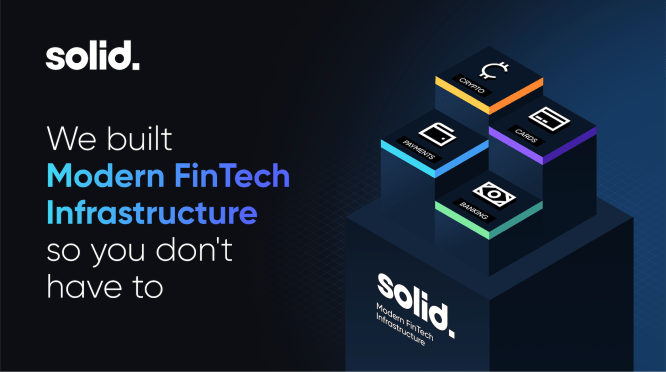

Venture funding Rounds: Discusses Series A/B/C stages’ impact on funding allocation and valuation potential, guiding investors in informed decision-making.

-

FTX Bankruptcy: Highlights risks in the crypto space during market volatility, underscoring challenges faced by high-risk investments post-pandemic.

-

Venture Capital Practices Post-IPO: Shifts focus to exits over acquisitions, indicating future growth directions favoring companies with strong market positions.

-

Connie Loizos’ Insights: Offers a broader perspective on tech news, providing context and highlighting lesser-known aspects of the industry ecosystem.

Key Takeaways:

- Technology in Risky Markets: AI is being applied innovatively in trading, offering new opportunities despite challenges.

- Export Strategies: Chinese companies adapt shipping routes and branch setups to navigate tariffs during the pandemic.

- Venture Capital Adjustments: Focus on exits as firms seek growth strategies amid reduced pre-IPO activity.

Overall, the article captures both specific company performances and broader industry trends influenced by COVID-19, illustrating opportunities and challenges faced by businesses.