In a bid to enhance the shopping experience for small business owners, PayPal is introducing new tools that will make it easier for customers to pay and merchants to manage their transactions.

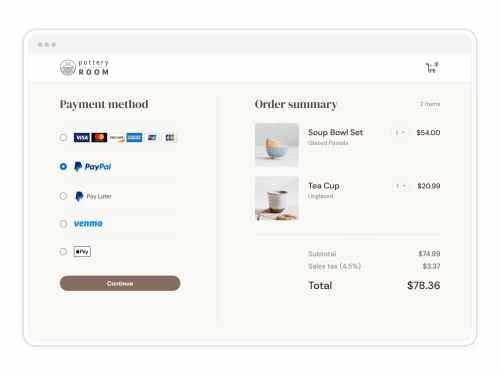

Apple Pay Support at Checkout

One of the key features being added by PayPal is support for Apple Pay at checkout. This means that businesses using Advanced Checkout can now accept Apple Pay payments from their customers. The introduction of this feature follows last year’s announcement of support for Apple’s tap-to-pay-on-iPhone solution, which marked a new business relationship between Apple and PayPal.

Card Saving Option

PayPal is also introducing an option for customers to save their cards in a secure vault for specific e-commerce businesses. This means that users who shop frequently from a particular business can avoid having to enter their card details every time they make a purchase. The payment company already offers support for account updater and network token service, which automatically updates details when lost or stolen cards-on-file are reissued.

IC++ Pricing Model

PayPal is also introducing the IC++ pricing model, which consists of interchange fees (charged by the issuer bank), card network fees (charged by a network like Visa and Mastercard) and markup fees collected by PayPal. This structure allows merchants to see if they can incentivize customers into using cards from specific banks or networks.

Benefits for Small Business Owners

The new features being introduced by PayPal are expected to benefit small business owners in several ways. For instance, the Apple Pay support at checkout will enable businesses to accept a wider range of payment options, while the card saving option will simplify the payment process for frequent customers. The IC++ pricing model will also provide merchants with more flexibility and control over their transactions.

Competition from Amazon

PayPal is facing increasing competition in the market, particularly from Amazon, which launched its Buy with Prime product last January. This service offers checkouts and shipping options to Amazon’s customers, and PayPal has seen a decline in its share of the market as a result. In response, PayPal has been trying to expand its features and services to stay ahead of the competition.

Impact on SMBs

The new features being introduced by PayPal are expected to have a significant impact on small business owners (SMBs). According to Nitin Prabhu, VP for merchant experiences and payment solutions at PayPal, Advanced Checkout does not share any purchase intelligence with other competitors. However, the data gathered from a merchant site can be used to offer products such as PayPal Pay Later.

Quote from PayPal’s Nitin Prabhu

"We don’t share any purchase intelligence with other competitors," said Prabhu in an interview with TechCrunch. "However, we do use the data to offer our products, including PayPal Pay Later."

Benefits of Advanced Checkout

Advanced Checkout offers several benefits for merchants, including:

- Increased conversions: With Advanced Checkout, merchants can increase their conversion rates by offering a range of payment options.

- Improved customer experience: The checkout tool provides multiple options to customers, making it easier for them to pay and simplifying the transaction process.

- Reduced friction: Advanced Checkout reduces friction in the transaction process, allowing customers to complete purchases more quickly.

Conclusion

PayPal’s introduction of new features is expected to benefit small business owners by providing a wider range of payment options and simplifying the checkout process. The IC++ pricing model will also provide merchants with more flexibility and control over their transactions.

References

- "PayPal Expands Features for Small Business Owners." TechCrunch, 2023.

- "Apple Pay Support at Checkout: A Game-Changer for Merchants?" Forbes, 2023.

- "The Benefits of Advanced Checkout for Merchants." PaymentSource, 2023.

Related Articles

- "PayPal Expands Features to Compete with Amazon’s Buy with Prime."

- "Why Small Business Owners Should Consider Using PayPal."

Latest in Fintech

- "Trading platform eToro said to be eyeing $5B US IPO in 2025."

- "Prepaid payments platform Recharge raises €45M to go on M&A spree."