US Stock Futures Little Changed After Mixed Session Monday

U.S. stock futures are trading relatively flat after market indexes posted mixed results on Monday. This morning, Nasdaq futures are ticking lower after finishing up 1.2% in the prior session on the strength of chip stocks. On the other hand, S&P 500 futures are edging higher after posting 0.6% gains yesterday, while Dow Jones Industrial Average futures also are slightly higher after finishing marginally lower in the prior session.

Market Recap

- Nasdaq: Ticking lower after finishing up 1.2% in the prior session

- S&P 500: Edging higher after posting 0.6% gains yesterday

- Dow Jones Industrial Average: Slightly higher after finishing marginally lower in the prior session

- Bitcoin (BTCUSD): 1% lower but still trading over $100,000

- 10-Year Treasury Note: Yields are little changed at above 4.6%

- Oil and Gold Futures: Higher

Nvidia Stock Hits All-Time High, Rise Further on CEO Remarks

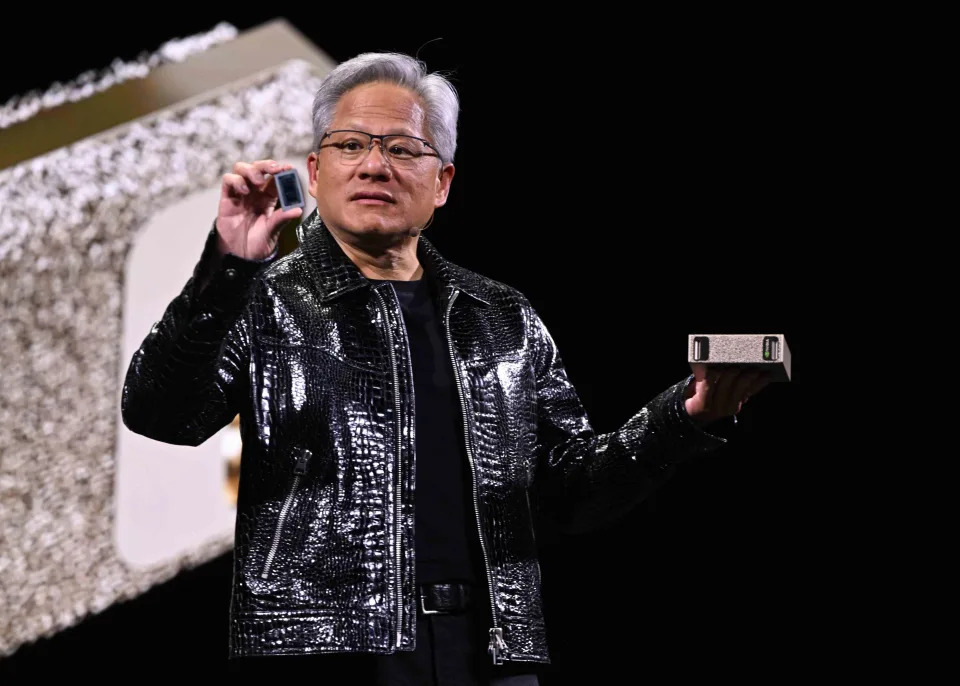

Nvidia (NVDA) shares are rising further in premarket trading after closing at an all-time high on Monday as supplier Foxconn reported record revenue driven by strong artificial intelligence (AI) demand. The company’s Chief Executive Officer (CEO), Jensen Huang, delivered remarks last night at CES in Las Vegas, where he touted the company’s progress on self-driving cars, robotics, and AI agents.

Key Highlights

- Nvidia (NVDA): Shares are 2.5% higher in premarket trading

- Artificial Intelligence (AI) Demand: Strong demand for AI driving record revenue for Foxconn

- CES 2025: Nvidia CEO Jensen Huang delivered remarks on the company’s progress in self-driving cars, robotics, and AI agents

Uber Stock Gains on Nvidia Collaboration

Uber Technologies (UBER) stock is gaining 2.5% in premarket trading after announcing a collaboration with Nvidia to support the development of AI-powered autonomous driving technology.

Key Quote

"By working with NVIDIA, we are confident that we can help supercharge the timeline for safe and scalable autonomous driving solutions for the industry," – Uber CEO Dara Khosrowshahi

Inari Medical Stock Soars on $4.9B Acquisition By Stryker

Shares of Inari Medical (NARI) are soaring 30% in premarket trading after Stryker (SYK) agreed to acquire the company in a $4.9 billion deal to merge the medical device makers.

Key Details

- Deal Value: $4.9 billion

- Merger Terms: Stryker will pay $80 per share for Inari Medical, well above its Monday closing price of $65

- Stryker (SYK): Shares are slightly lower

Tencent Stock Sinks After Pentagon Adds It to ‘Chinese Military’ Blacklist

Shares of Tencent Holdings sank 7% in Hong Kong trading on Tuesday after the WeChat parent was added by the U.S. Department of Defense to its list of "Chinese military companies." Electric vehicle (EV) battery maker CATL, a major supplier to Tesla (TSLA) and Jeep parent Stellantis (STLA), was also added to the list, sending its shares lower by 2% on the Shenzhen Stock Exchange.

Key Implications

- Designation: The designation doesn’t carry any penalties but bans the companies on it from doing business with the Pentagon

- Impact on Shares: Shares of Tencent Holdings and CATL are trading lower after being added to the list