The mortgage loan origination process is notorious for being painful and tedious. In an effort to simplify, speed up, and reduce costs, a pair of former Blend employees have teamed up to build mortgage loan origination software that connects banks, credit unions, mortgage bankers, and brokers. Their goal is to make the lending process easier and more transparent for customers.

The Need for More Efficient Loan Origination Systems

The sheer volume of loan originations underscores the need for more efficient loan origination systems (LOS). According to the Mortgage Bankers Association, there will be over $2.59 trillion in loan originations in 2022. While down from the previous year, which saw a significant jump in refinancings and new home purchases due to historically low interest rates, that’s still a massive number of loans. Inefficiencies in the process are rampant, leading to longer closing times and higher associated fees.

The Evolution of Mortgage Infrastructure

During their time at Blend, Mike Yu and Devon Yang realized that current mortgage infrastructure has not kept up with the pace of change in more digitally native industries. This is a common refrain in the industry, which is why we’re seeing an increasing number of startups pop up in the space. For example, Polly recently announced it had raised $37 million in a round led by Menlo Ventures to automate workflows for mortgage lenders.

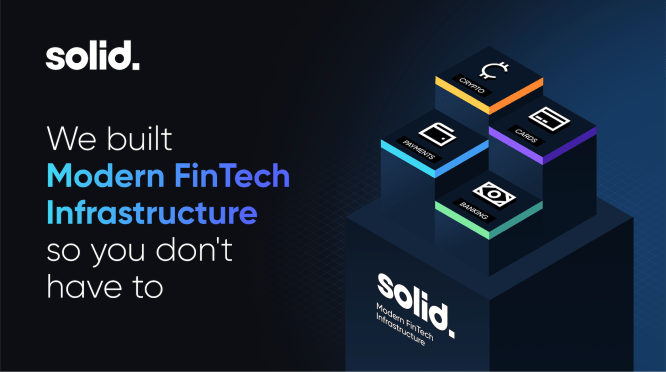

Vesta’s Vision: Simplifying the Mortgage Loan Origination Process

Vesta aims to revolutionize the mortgage loan origination process with its software, which connects banks, credit unions, mortgage bankers, and brokers. The goal is to make the lending process easier and more transparent for customers. With Vesta, lenders can originate loans more efficiently, reducing closing times and associated fees.

The Potential Impact of Vesta’s Software

Historically, much of the mortgage market has been built atop antiquated technology from the 1980s, which has slowed progress, hindered innovation, access to affordable rates, and stifled competition. By simplifying the mortgage loan origination process, Vesta has the potential to level the playing field for lenders, making it easier for customers to access affordable loans.

The Funding Round: $30 Million to Fuel Growth

Vesta recently raised $30 million in funding to fuel its growth. This investment will enable the company to further develop its software and expand its reach into new markets. With this significant influx of capital, Vesta is poised to make a major impact on the mortgage lending industry.

Industry Reaction: A "Massive, Non-Obvious" Opportunity

The industry has taken notice of Vesta’s innovative approach to mortgage loan origination. Charles Rollet, a prominent figure in the fintech space, noted that Vesta is tackling a "massive, non-obvious" opportunity in a highly fragmented industry.

Conclusion: A Bright Future for Vesta and the Mortgage Lending Industry

Vesta’s software has the potential to revolutionize the mortgage loan origination process. With its innovative approach and significant funding, the company is poised to make a major impact on the industry. As the fintech space continues to evolve, Vesta is well-positioned to lead the charge in simplifying and streamlining the mortgage lending process.